Who should read this guide?

This is a guide about Airbnb Co-Host accounting and automation with Xero. An Airbnb Co-Host manages Airbnb properties on behalf of home owners and real estate investors without managing owner funds. If you want to avoid a traditional property management arrangement due to licensing requirements in your jurisdiction, this business model may be the perfect fit for you. Rather than the owner receiving funds from an Airbnb Co-Host, the owner receives the funds directly from Airbnb. Overall, this business model is preferred for those Airbnb operators who prefer not to manage funds on behalf of owners due to local licensing requirements.

USING QUICKBOOKS? READ THIS ARTICLE INSTEAD

Co-Hosting on Airbnb can be quite lucrative, but only when the numbers work in your favor. The way to success in this venture is by keeping track of your earnings for each listing and for each owner. Having an optimized system of accounting will help you to keep track and know what your earnings are for each listing. In this guide, we’ll go over how to implement and automate Airbnb Co-Host accounting using Xero accounting software.

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Airbnb Costs and Chart of Accounts to Consider

Table of Contents

What you’ll get from this guide:

- A template for Xero with detailed chart of accounts for Airbnb Co-Hosts

- Learn how to automate Airbnb Co-Host accounting with Tallybreeze

- Execute common transaction workflows in Xero

- Generate monthly owner statements and reports for your clients

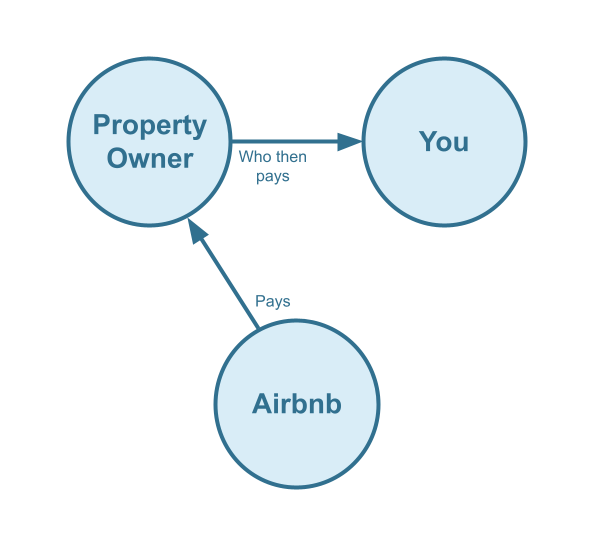

Cash Flow Diagram

Specifically in this guide, we’ll focus on the scenario where 1.) the property owner receives all funds from Airbnb, 2.) the Airbnb Co-Host invoices the owner for commissions & cleaning fees and 3.) the owner pays the Airbnb Co-Host at a later date.

NOTE: There is indeed another cash flow model where the Airbnb Co-Host and property owner get paid directly from Airbnb through a split payment, but this model is beyond the scope of this guide and will be covered in another guide.

Here’s the cash flow diagram we’ll be focusing on in this guide:

Who should not read this guide?

There are other business models that may be more suitable in your particular scenario, which are covered better in the following guides:

- Airbnb Arbitrage Accounting with Xero

- Airbnb Property Management Accounting using Xero

- Trust Accounting for Airbnb Property Managers using Xero

- Airbnb Investment Accounting with Xero

- All Airbnb templates for Xero

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

Airbnb Co-Host: Xero Chart of Accounts

Airbnb Co-Hosts find our chart of accounts template to be extremely helpful. Quite straight-forward, this template helps to easily track amounts paid by guests and, in turn, tracks the amounts owed by owners.

Account Codes

| No. | Account | Type |

|---|---|---|

| 43100 | Co-Host Revenue – Airbnb Income – Accommodation Fare | Revenue |

| 43200 | Co-Host Revenue – Airbnb Income – Cleaning Fee | Revenue |

| 43300 | Co-Host Revenue – Airbnb Income – Resolution Adjustment | Revenue |

| 43400 | Co-Host Revenue – Airbnb Refund – Accommodation Fare | Revenue |

| 43500 | Co-Host Revenue – Airbnb Refund – Cleaning Fee | Revenue |

| 43600 | Co-Host Revenue – Airbnb Refund – Resolution Adjustment | Revenue |

| 52100 | Co-Host Costs – Airbnb Service Fee | Cost of Service |

NOTE: We only cover income accounting in this guide, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Airbnb Costs and Chart of Accounts to Consider

Detailed Explanation of Accounts

For a detailed understanding of accounts, we’ve defined each here.

Co-Host Revenue

43100 – Co-Host Revenue – Airbnb Income – Accommodation Fare – This account tracks Co-Host commissions earned from the accommodation fare line item of an Airbnb reservation.

43200 – Co-Host Revenue – Airbnb Income – Cleaning Fee – This account tracks Co-Host cleaning fees earned from the cleaning fee line item of an Airbnb reservation and is separate from the Accommodation Fare.

43300 – Co-Host Revenue – Airbnb Income – Resolution Adjustment – This account tracks Co-Host amounts earned from the Resolution Adjustment claims related to an Airbnb reservation.

43400 – Co-Host Revenue – Airbnb Refund – Accommodation Fare – This account tracks refunds of Co-Host commissions earned from the Accommodation Fare line item of an Airbnb reservation.

43500 – Co-Host Revenue – Airbnb Refund – Cleaning Fee – This account tracks refunds of Co-Host cleaning fees earned from the Cleaning Fee line item of an Airbnb reservation.

43600 – Co-Host Revenue – Airbnb Refund – Resolution Adjustment – This account tracks refunds of Co-Host amounts due to Resolution Adjustment claims against the Co-Host for any particular reservation.

Co-Host Costs

52100 – Co-Host Costs – Airbnb Service Fee – This account tracks the Co-Host portion of the Airbnb Service Fee (also known as “host fee”) charged by Airbnb for each reservation and a direct cost of obtaining the reservation.

Accounts not included in this template

For the scope of this guide, we’re mainly focused on tallying amounts owed by and invoiced to owners. It is important to point out that our template does not include many general accounts. We also make reference to some accounts not included in this particular template, which we’ll list here:

- 11000 – Airbnb Payment Clearing Account – This account is created by Tallybreeze (formerly Bnbtally) but is not included in this template in particular. This account is used to apply payments to Airbnb invoices upon the day the Airbnb reservation payout is posted. Payouts can take 3-5 days (or longer) to arrive in the bank account after posted from Airbnb. Monies owed are held in this clearing account until the payouts are received in the bank. This account also helps to automate the reconciliation process in Xero.

- 1XXXX – Operations Bank Account – This is your business operations bank account set up with your financial institution. It’s a cash asset account to facilitate your Airbnb Co-Host company’s day-to-day business operations.

- 4XXXX – Billable Expenses Income – This is a general account for capturing income received for the payment of billable expenses by owners, which may include a markup.

- 7XXXX – Billable Expenses – This is a general account for tracking billable expenses for any owners.

Quick Setup Steps

Here’s how to import the above chart of accounts template. All of the accounts discussed in this article can be imported into Xero automatically using Bnbtally’s setup tools. Here’s how to access this utility…

- If you haven’t already, Sign Up to Tallybreeze. It includes free use of this template.

- Once registered, go to the Connections manager in Tallybreeze. Connect your Airbnb account, connect your Xero account and then create a connection between the two.

- Within the Connection settings, select “Set Up Xero”

How to Automate Airbnb Co-Host Accounting

With Tallybreeze (formerly Bnbtally), you’re able to track every penny from Airbnb in great detail. This is important since you need to justify to the owner precisely how you came to the amounts you have billed them. In this section, we’ll discuss the automation presets for the Airbnb Co-Host business model.

In Tallybreeze, you’ll first need to connect your Airbnb and Xero accounts, once this is complete, you can set specific accounting rules for each listing. Then, when a reservation is received from Airbnb, Tallybreeze can create an invoice automatically in Xero with precise allocations set for co-host commissions, cleaning fees and any other allocation needed.

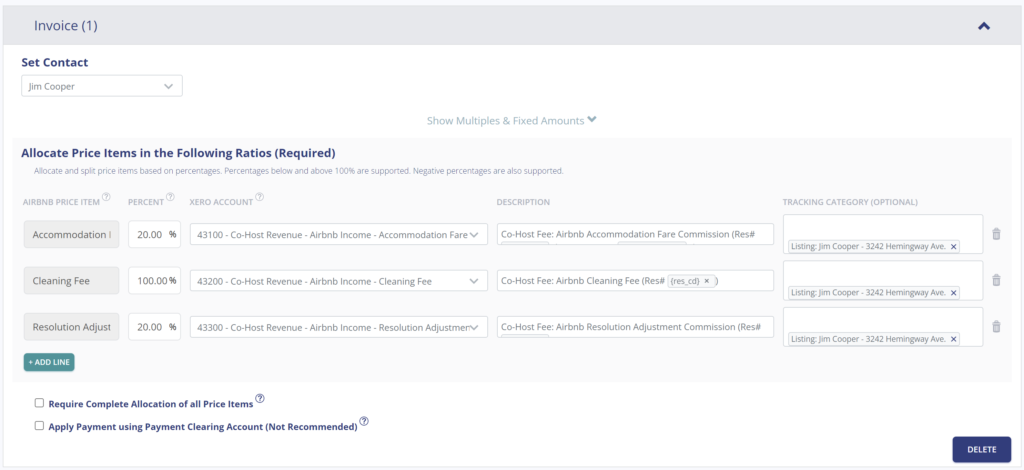

Tallybreeze Listing Presets

To get started quickly, Tallybreeze (formerly Bnbtally) provides a free chart of account template and preset for Airbnb Co-Hosts. When selecting your listing, you can select to preload the Airbnb Co-Host preset. Here’s an example:

Explanation of Preset Lines

In this example, for each reservation Tallybreeze will create an invoice. We recommend that you set the owner as the customer. The first line of the invoice allocates 20% of Accommodation Fare to be received as a co-host fee from the owner. The second line allocates the entire the Cleaning Fee to be received from the owner. Finally, the third line takes 20% of any Resolution Adjustments to be received by the owner.

| Airbnb Price Item | % | Account |

|---|---|---|

| Accommodation Fare | 20% | 43100 – Co-Host Revenue – Airbnb Income – Accommodation Fare |

| Cleaning Fee | 100% | 43200 – Co-Host Revenue – Airbnb Income – Cleaning Fee |

| Resolution Adjustment | 20% | 43300 – Co-Host Revenue – Airbnb Income – Resolution Adjustment |

Example Reservation

Let’s say you have Tallybreeze set up for this listing using the preset settings above. Let’s say Airbnb sends a payout for a current reservation with the following itinerary price items:

- Accommodation Fare: $1750

- Cleaning Fee: $150

With the above presets, Tallybreeze calculates and allocates 20% of the Accommodation fare ($1750 * 20% = $350) and then allocates the entire Cleaning Fee ($150). The invoice is not paid automatically, as the payment will be received from the owner. The total amount to be received from the owner is $500.

| Account | Debit | Credit |

|---|---|---|

| 43100 – Co-Host Revenue – Airbnb Income – Accommodation Fare | $350 | |

| 43200 – Co-Host Revenue – Airbnb Income – Cleaning Fee | $150 | |

| 1XXXX – Accounts Receivable (Asset) | $500 |

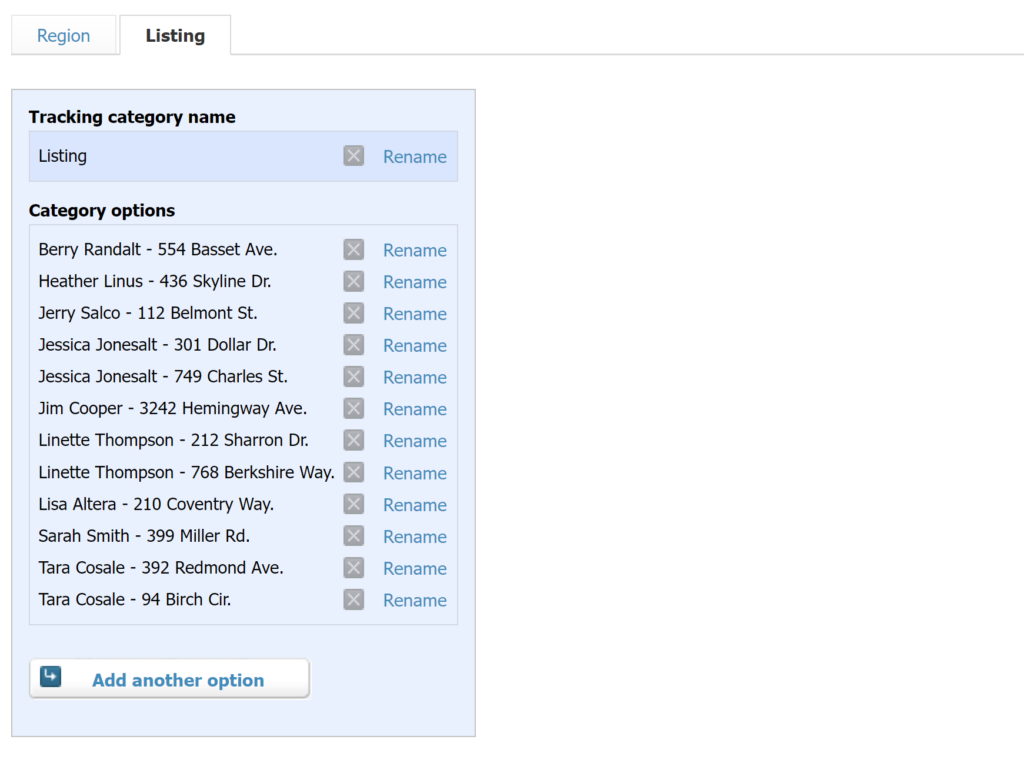

Set Invoice Customer & Tracking Categories

In Tallybreeze, it’s appropriate to set the owner as the customer of each listing. This setting can be found in your invoice rules of each listing. It’s also appropriate to create a tracking category in Xero for each listing.

Automate Additional Bills & Invoices (Optional)

With Tallybreeze, you’re also able to automate the creation of additional bills and invoices for each reservation. Consider the following:

- Create a bill to set amounts payable to a cleaning service for turnover of each reservation.

- Create additional invoice to set amounts receivable by any third party for each reservation.

Quick Setup Steps

All of the above settings can be quickly set up using Tallybreeze’s presets for your listings. Here’s how to set up these presets…

- If you haven’t already, Sign Up to Tallybreeze.

- After logging into Tallybreeze, set up your connections, then go to Listing Rules.

- Select any listing you’d like to automate that hasn’t already been set up.

- Select “Load Presets”.

From here, presets will be loaded as your listing accounting rules and you can edit as needed.

Airbnb Co-Host: Common Transaction Workflows in Xero

Once a proper Tallybreeze setup is complete, your Airbnb reservation accounting is automated. In this section, we’ll focus on other common transaction workflows that are related to an Airbnb Co-Host business.

Receiving Payment from Owners

With Tallybreeze, invoices for each reservation have already been generated for each owner. Given such, the amount that needs to be received from each owner can be found in the balance sheet under Accounts Receivable. Xero automatically accumulates the sum of all invoices under each owner, making it easy for you to request payments.

Example Transaction

You, the Airbnb Co-Host, have received a payment in the amount of $3130 from the property Owner, Tara Cosale. You’d like to reconcile the amount properly from your Operations Bank Account using the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $3,130 | Tara Cosale | |

| 1XXXX – Accounts Receivable (Asset) | $3,130 | Tara Cosale |

Detailed instructions for Xero

1. Find the amount to receive

The amount that needs to be received from each owner can be found under “Business” -> “Sales Overview” -> “Send Statements”. From there select the date range and the amount owed is listed for each customer. Select any specific customer for a detailed list of invoices outstanding:

2. Receive Payment

Email the above statement to the owner to receive a payment.

3. Reconcile bank deposit with receive payment

When the bank deposit is received, reconcile it with the invoices listed in step 1.

Paying Expenses on Behalf of Owners

Sometimes when an issue comes up and needs quick attention or repair work done on site, you may need to pay for these types of expenditures from your business operations bank account. If this is part of your agreement with your owners, then you can bill the owner for the amounts receivable at a later date. Check the following example:

Example

A property owned by Tara Cosale needs a bathroom faucet to be replaced by a professional plumber. The service costs a total of $450 and needs to be rectified quickly as there are guests checking in later in the day. You also charge a 10% markup for allocating funds and handling these kinds of issues for the owner.

First, you’ll need to pay the plumbing company from your Operations Bank Account either via bank transfer, ACH, check, Venmo or other means. Once the transaction is posted and complete, record the outgoing transaction from your Operations Bank Account using the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $450 | Tara Cosale | |

| 7XXXX – Billable Expenses (Expense) | $450 | Tara Cosale |

Next, create an invoice for the amounts owed by the owner. Include a 20% markup for coordinating & funding the service, and allocate it to your billable expenses income account. Use the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 4XXXX – Billable Expenses Income (Revenue) | $540 | Tara Cosale | |

| 1XXXX – Accounts Receivable (Asset) | $540 | Tara Cosale |

Detailed instructions for Xero

1. After paying the service provider, categorize and reconcile the transaction in your operations bank feed

Be sure to mark the Bill line item as billable to the owner.

| Payee | Category | Description | Amount | Tracking Category |

|---|---|---|---|---|

| Plumber Pro | 7XXXX – Billable Expenses (Expense) | “Billable Expense: Bathroom Faucet Replaced” | $450 | Tara Cosale |

2. Receive Payment from Owner

Include a 20% markup ($540 total)

Airbnb Co-Host Reports & Monthly Owner Statements

With Tallybreeze (formerly Bnbtally), data from Airbnb is seamlessly synced into Xero. This means that after you’ve processed and reconciled any remaining expenses, it will be simple to produce beautiful owner statements each month.

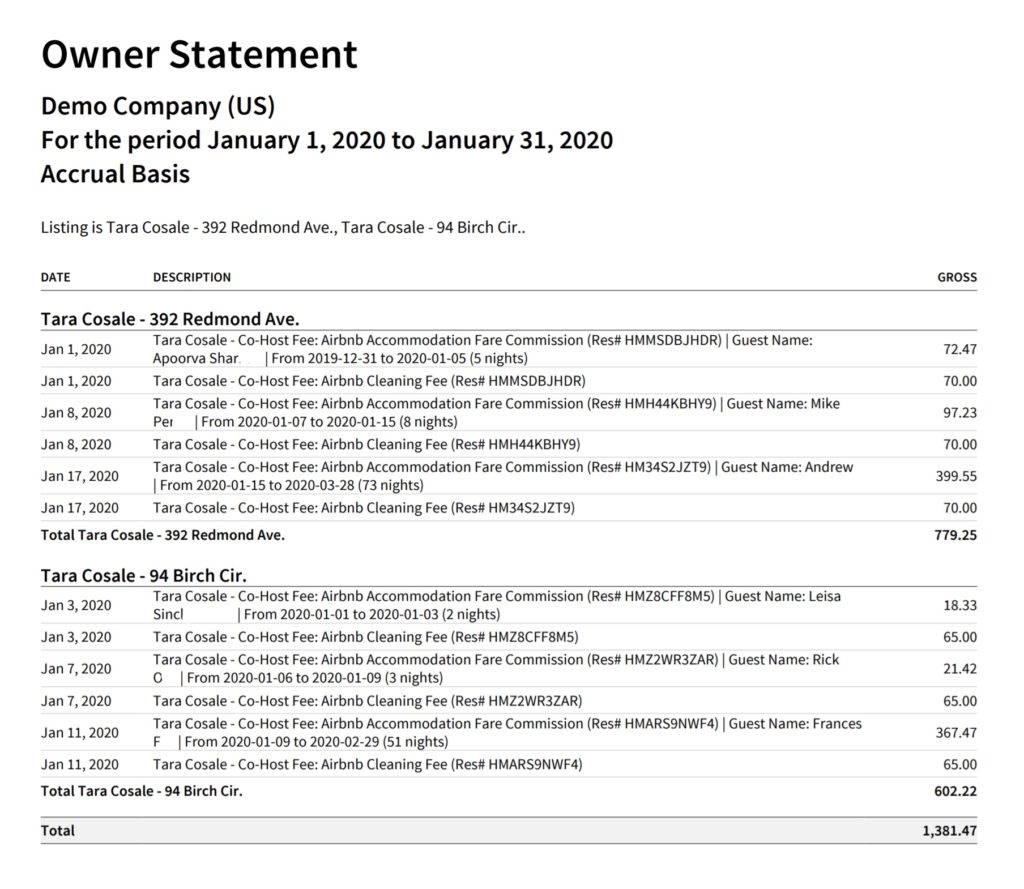

Monthly Owner Statement by Listing

Each month in Xero, you’ll be able to produce a monthly owner statement which shows precisely what’s owed by the owner for each listing. This report is grouped by listing and shows the owner exactly what is owed for each reservation, followed by a total for each listing. Finally, a grand total due from the owner is displayed at the bottom.

In the following example, we’re showing an owner statement for a single owner, Tara Cosale:

Quick Setup Steps

Here’s how to create this Owner Statement by Listing in Xero:

- In Xero, go to Reports, select “Account Transactions”

- Under Accounts, select the following: 43100, 43200, 43300, 43400, 43500, 43600, 52100

- Select the report period (perhaps the previous month)

- Under “Columns” select the following: Credit, Debit, Date, Description

- Under Grouping/Summarizing, select the Tracking Category you have for your listings

- Under Filter, select the listings you’d like to report.

- Select “Update”

From here this statement can be saved as a custom report and re-used every month for the owner.

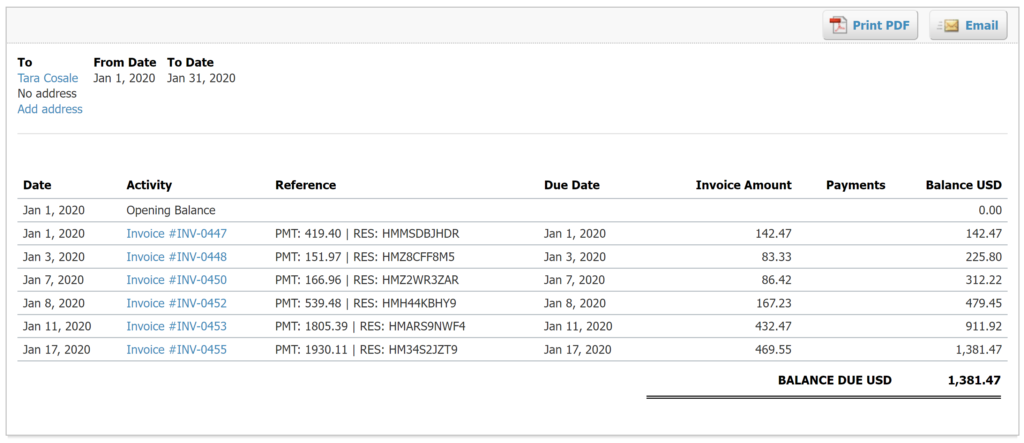

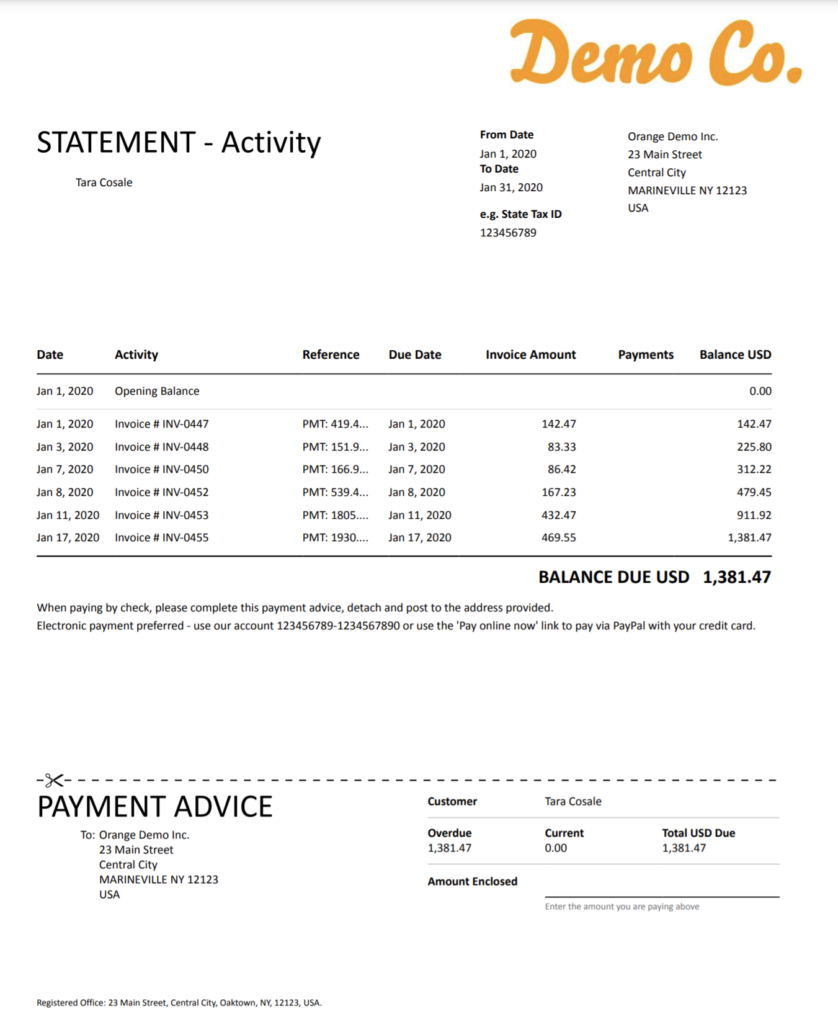

Monthly Owner Statement by Owner

Xero has a second, more official way to compile a statement for owners. It includes your company logo and looks even more professional. Xero provides a special statement for outstanding invoices. To access this go to “Business” -> “Sales Overview” -> “Send Statements”. From there select the date range and select the specific owner to get their statement. From there you can print or email this statement to your owner with a request for payment:

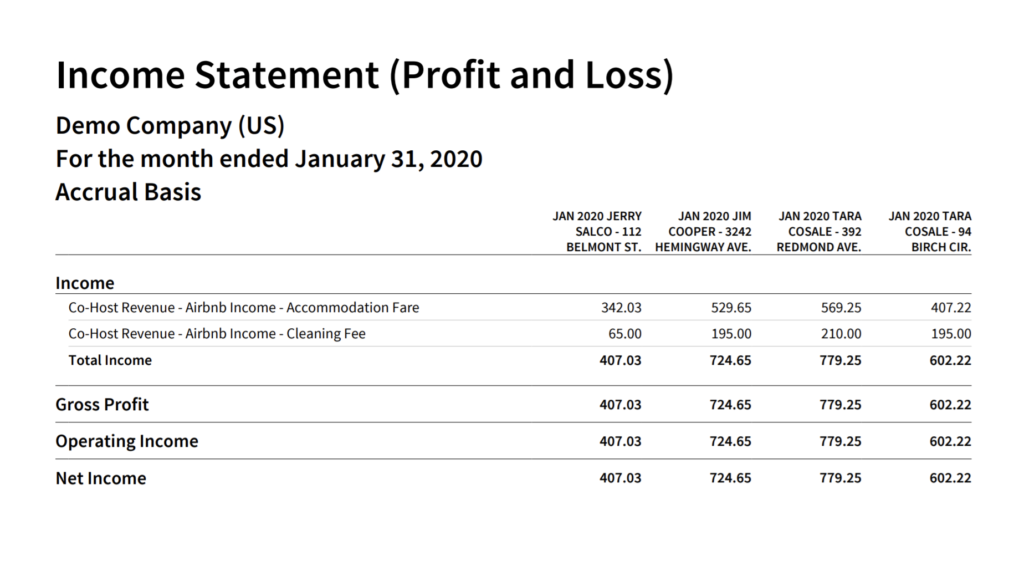

Income Statement per Listing

The purpose of the income statement by listing is for you to understand the performance of your own Airbnb Co-Host business and a comparison between listings. Therefore, this report is used for internal purposes to give you an idea of what owners and listings are earning the best in comparison to each other.

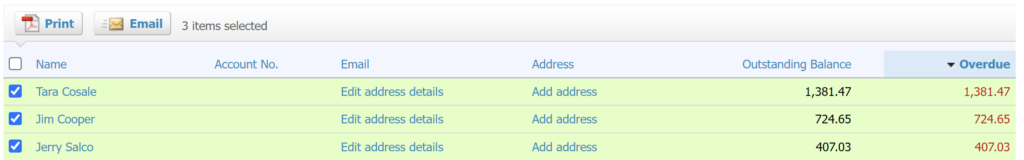

Receive Payment from Each Customer

Xero provides an easy way to run a statement of receivables for each owner which serves both as a great way to report to owners what’s owed and collect a payment for all outstanding invoices. To do this in Xero, go to “Business” -> “Sales Overview” -> “Send Statements”. From there select the date range.

From there you’ll find a list of total amounts owed from each customer and a way to email a payment request from each:

Conclusion

Operating as an Airbnb Co-Host can be quite lucrative, but you’ll need to put in place a streamlined and precise accounting process to accurately communicate financials with owners and make sure you’re going in the right direction. Fortunately, with a bit of diligence, automating your accounting process will allow you to be more hands-off while providing the confidence and transparency in the numbers your clients need.

We hope that these tips will make it easier for you to keep track of all of your Airbnb reservations, including associated taxes and hosting fees. If an accounting automation sounds like something that would be useful in helping you scale your business, be sure to check the link below:

Finally, there are other business models that are not covered in this guide but are covered better in the following guides. Be sure to check these out :

6 thoughts on “Airbnb Co-Host: An Accounting Guide for Xero”

Comments are closed.