Why read this guide?

In this guide, we discuss Airbnb accounting and bookkeeping in-depth using popular accounting software, QuickBooks Online & Xero. Accordingly, we provide chart of account templates, show how to properly classify transactions, discuss financial reporting, Airbnb taxes and overview how to automate Airbnb bookkeeping. We link to various business models, including property managers, property owners, co-hosts and arbitrage operators.

Avoid Common Mistakes! So many people are misreporting their numbers and causing tax auditing flags because they’re basing their Airbnb accounting purely off of what they receive in their bank account. Mistakes like this are sadly common. In this guide, we’ll go over the most common Airbnb accounting & bookkeeping mistakes and how to avoid them.

Building an Airbnb and short-term rental business can be incredibly rewarding and lucrative, but getting your numbers precise is more important than ever before. Accordingly, the more thorough your Airbnb accounting and bookkeeping methodology, the easier you’ll sleep at night and the more successful you’ll become in this industry.

You have obligations

When operating an Airbnb business, you have obligations. In Airbnb accounting, there are three primary types of parties who you are obligated to:

- To Yourself & Partners. You are obligated to yourself and your own peace-of-mind to run a profitable operation and build your net worth. Airbnb guests are awesome, but not if you’re losing money. Proper Airbnb accounting keeps you focused on activities that produce wealth for yourself (and any partners) after paying employees, service providers and creditors.

- To Homeowners & Investors. If you’re managing properties on behalf of homeowners or real estate investors, you have a fiduciary obligation to report financial statements and pay rental proceeds. The more transparent you are with your numbers, the more you’ll build trust with your clientele and the more value they’ll see in your services.

- To Tax Authorities. You’re obligated to report and pay taxes to tax authorities. This includes federal, state and any local transient occupancy taxes. Avoid an audit, pay what’s owed in taxes and don’t pay anything more than you owe.

Table of Contents

- Introduction

- Common Mistakes & Challenges

- Chart of Accounts

- Classify & Reconcile Airbnb Reservations

- Automation with Tallybreeze

- Financial Statements & Reporting

NOTE: This is an intermediate accounting guide where we demonstrate how to apply the discipline of accounting and bookkeeping practices to an Airbnb business. If you’re an absolute beginner to accounting in general, consider first checking out the free accounting course by the Small Business Association: Introduction to Accounting

Airbnb Accounting: Introduction

“Accounting is the language of business. It is the art of recording, classifying, summarizing and analyzing the financial events of a business for the purpose of communicating financial information to all interested parties.” – sba.gov

So far, you’ve set up listings on Airbnb, you’ve received reservations and are getting reviews from guests on the platform. You already have a bank account dedicated to your Airbnb operations. As a result, Airbnb has submitted payouts to your bank account and you’re making significant income. Congratulations, you’re in business! If you haven’t done so already, now is the time to measure your success.

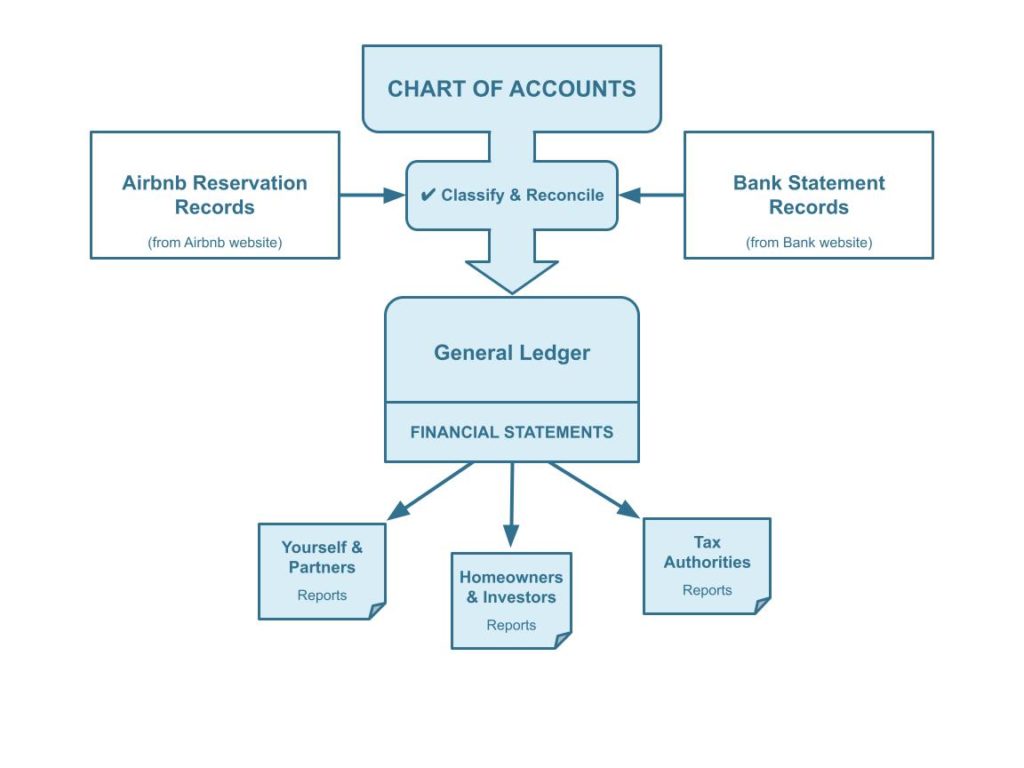

Airbnb accounting and bookkeeping is about classifying, reconciling and summarizing reservations and bank payouts received by Airbnb along with their associated costs. The essence of Airbnb accounting and bookkeeping is depicted in the blue portion of this diagram:

The white boxes on the left and right depicted in the diagram represent our primary inputs:

- Airbnb Reservation Records. These are the list of reservations retrieved from the Airbnb website, including the breakdown of all charges.

- Bank Statement Records. These are retrieved from your bank’s website, it is the source of truth in terms of what payouts were actually received by Airbnb as well as any other transactions that have occured.

- Note: Any other set of records not shown in the above diagram that provides a chronological list of financial events is of interest (e.g.) utility statements, maintenance bills, rent/mortgage statements, etc… all of which need to be reconciled against the bank statement.

Down the center of the above diagram depicted in blue is the core Airbnb accounting system focused in this article:

- Chart of Accounts. This is an index of categories that follow your business model and is used to classify and record transactions into the general ledger.

- Classify & Reconcile. This is the process of comparing the bank statement records against the Airbnb reservation records (and any other records), and categorizing them using the chart of accounts. The result of which ends up recorded in the general ledger. This is the core activity of Airbnb bookkeeping.

- General Ledger. “The general ledger is the major component of most accounting systems. It permits recording transactions on a double-entry basis in detail.” (mass.gov). The general ledger is a database that holds the classification of all transactions in the form of an extensive list of debits and credits, each record is allocated to a chart of account code. The purpose of the general ledger is to come to an equilibrium – a balance of the sum total of debits with the sum total of credits – which is the foundation of double-entry bookkeeping.

- Financial Statements. Finally, this is the outcome of all our hard work. Financial statements are precise reports with the purpose of communicating financial information to all interested parties: yourself, your partners, homeowners, investors and tax authorities. In this article, we’ll go over various reports and charts which you’ll find interesting.

Getting paid by Airbnb

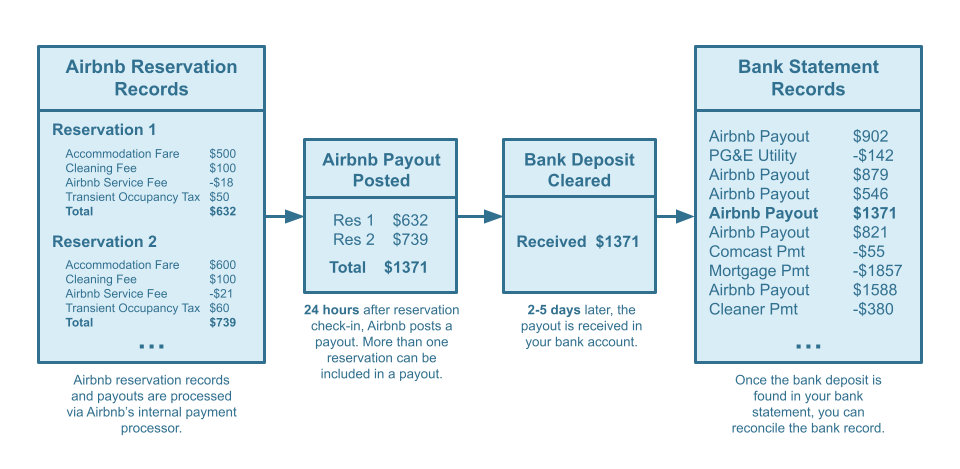

Let’s talk about how you get paid by Airbnb. Over a period of time, Airbnb reservations are accumulated until a payout is posted to your bank as depicted here:

Airbnb’s internal payment processor posts payouts to your bank account 24 hours after the check-in date of each reservation. You may notice that Airbnb combines several reservations from various listings into a single payout. Then, within 2-5 days, your bank receives the payout and the bank deposit is cleared. At this point, you can see a new deposit listed in your bank statement records.

Common Mistakes and Challenges

Mistake: Determining Airbnb income solely from what’s received in your bank account

This is a big mistake. Many people are misreporting their numbers and causing tax auditing flags because of this mistake. When you do this, you are under-reporting your revenue (which can flag an audit) while simultaneously ignoring Airbnb service fees and refunds for write-offs. How? Because Airbnb subtracts their service fees and any refunds before sending you a payout.

To appropriately account for any revenue received by Airbnb, for each reservation you need to classify the parts of the Payout. Consider the following equation:

Definition of a Payout for a single Airbnb reservation:

Payout = Accommodation Fare + Cleaning Fee − Airbnb Service Fee − RefundsIn other words, the solution is to have a chart of account code in your Airbnb bookkeeping for each line item on the right side of the equation, rather than merely bulk-allocating the left side. Continue reading this guide to learn about the chart of accounts and how to process each line item automatically for each reservation.

Challenge: Splitting Airbnb reservation payouts with other parties

In addition to what’s discussed above, there’s an extra challenge for property managers who split a commission from Airbnb payouts. For example, some property managers make a deal with property owners based on the Payout (e.g. splitting a 20% commission from the Payout) while forgetting to keep in mind the Payout equation.

It is important to remember that if you are splitting a commission based on the Payout, what you are really doing is splitting a commission of all its parts. Consider the following equation:

What it really means to split 20% of a Payout:

(20%)(Payout) = (20%)(Accommodation Fare + Cleaning Fee − Airbnb Service Fee − Refunds)

From the above equation, we can infer the following:

(20%)(Payout) = (20%)(Accommodation Fare) + (20%)(Cleaning Fee) − (20%)(Airbnb Service Fee) − (20%)(Refunds)The above equation may be trivial but many property managers are so used to viewing Airbnb income purely from the perspective of the Payout that many forget the breakdown on the right side of the equation. The solution is to have an Airbnb bookkeeping system that views any split of a reservation Payout as a split of each of its parts. Such a view is discussed in this article with great detail.

Challenge: Categorizing multiple reservations combined into a single payout

A payout from Airbnb can include multiple reservations from various listings. This poses a bookkeeping challenge that requires utmost attention to details during the categorization and reconciliation of payouts.

In Airbnb bookkeeping, it is important to itemize each reservation within a payout. This is because in most scenarios, you want to know how much income you’re receiving from one reservation vs another as well as from one listing vs another, so that you can determine which listings are more profitable than others.

The solution is to have an Airbnb bookkeeping system that automates the categorization of each reservation in each payout. This is discussed in great detail throughout this article.

Mistake: Incorrectly interpreting Airbnb’s 1099-K

In the United States, if you make more than a certain threshold, Airbnb will send a 1099-K to the IRS declaring how much they’ve paid you for the previous tax year. Many people overpay in taxes because they assume the numbers from Airbnb’s 1099-K is what they’ve received from Airbnb for the year without checking their records. In this case, it is mistakenly assumed that Airbnb is reporting the net earnings after Airbnb service fees and refunds, when it is really reporting the gross amounts before deductions. This is a big mistake.

Airbnb’s 1099-K is a report on gross amounts earned and does not subtract Airbnb service fees or refunds. The solution is to have an Airbnb bookkeeping system that keeps track of these line items for each reservation, which is discussed in detail in this article.

Airbnb Accounting: Chart of Accounts

“The general ledger is the bookkeeping system used to record the financial transactions an agency or organization conducts. It is on the general ledger that all accounting/financial entries are found, and that information is used to create financial statements. The chart of accounts is a list of all accounts used to record financial position and activity in the general ledger.” – ojp.gov

List of Airbnb Business Models

In Airbnb accounting, there are several business models with various chart of accounts. The business model determines the chart of accounts as each has a unique way of classifying financial events.

For example, if you own an Airbnb property, then 100% of the accommodation fare received by Airbnb is considered income to you. However, if you’re a property manager who is managing a Trust Account, then 100% of the accommodation fare is considered income to the Trust Account while only a commission (say 20%) is considered income to you.

To this end, each business model linked below outlines a different way an Airbnb professional can build wealth. Select a template below to learn more:

- Airbnb Investment Accounting: QuickBooks | Xero

- Airbnb Arbitrage Accounting: QuickBooks | Xero

- Airbnb Co-Host Accounting: QuickBooks | Xero

- Airbnb Property Management Accounting: QuickBooks | Xero

- Trust Accounting for Airbnb Property Managers: QuickBooks | Xero

- Airbnb Costs for all Business Models: QuickBooks | Xero

Chart of Accounts for Airbnb Reservations (Example)

In this guide, we’re using the Airbnb investment property business model as an example. All templates listed are provided by Tallybreeze (formerly Bnbtally) and can be imported into QuickBooks or Xero:

| No. | Account | Type |

|---|---|---|

| 11000 | Airbnb Payment Clearing Account | Asset |

| 24000 | Rental Liability | Liability |

| 24200 | Rental Liability: Airbnb Custom Taxes Payable | Liability |

| 42000 | Rental Revenue | Revenue |

| 42100 | Rental Revenue: Airbnb Income – Accommodation Fare | Revenue |

| 42200 | Rental Revenue: Airbnb Income – Cleaning Fee | Revenue |

| 42300 | Rental Revenue: Airbnb Income – Resolution Adjustment | Revenue |

| 42400 | Rental Revenue: Airbnb Refund – Accommodation Fare | Revenue |

| 42500 | Rental Revenue: Airbnb Refund – Cleaning Fee | Revenue |

| 42600 | Rental Revenue: Airbnb Refund – Resolution Adjustment | Revenue |

| 51000 | Rental Costs | Cost of Service |

| 51100 | Rental Costs: Airbnb Service Fee | Cost of Service |

| 61100 | Airbnb Tax Withholdings | Expense |

NOTE: In this guide, we primarily cover reservation accounting. For a guide about Airbnb costs and chart of accounts to consider, check out this guide: Airbnb Costs and Chart of Accounts to Consider

Airbnb Bookkeeping: Classify & Reconcile Reservations

“Reconciliation is an accounting process that compares two sets of records to check that figures are correct and in agreement. Reconciliation also confirms that accounts in the general ledger are consistent, accurate, and complete.” – Investopedia

“Bank reconciliations are a necessary control to safeguard cash against fraud and losses and to ensure the accuracy of accounting records. Reconciliation of cash activity is necessary to demonstrate that activity is valid.” – wa.gov

Using our chart of accounts for Airbnb investment properties, we can now demonstrate how to classify and reconcile a set of reservations using our Airbnb bookkeeping system. Following is an example set of reservations pulled from our list of Airbnb Reservation Records, which we want to classify and reconcile with a Bank Statement Record.

Example Payout with Multiple Reservations & Refunds

Let’s say Airbnb sends a payout to your bank account “1XXXX – Bank Account”, which includes two reservations and a refund:

Reservation 1 from Listing A

- Accommodation Fare: $3000

- Cleaning Fee: $500

- Airbnb Service Fee: -$100

- Airbnb Transient Occupancy Taxes: $300

- Reservation Total: $3700

Reservation 2 from Listing B

- Accommodation Fare: $1000

- Cleaning Fee: $200

- Airbnb Service Fee: -$50

- Airbnb Transient Occupancy Taxes: $100

- Reservation Total: $1250

Refund for Previous Reservation from Listing B

- Accommodation Fare: -$500

- Cleaning Fee: -$100

- Airbnb Service Fee: +$30

- Airbnb Transient Occupancy Taxes: -$50

- Refund Total: -$620

Airbnb Payout Total: $4330

Classify Reservation & Refund Line Items

First, we want to account for all amounts posted from Airbnb, separating out each price item and then transfer everything posted to the Airbnb Payment Clearing Account.

Reservation 1 from Listing A: The total amount to be received from this reservation is $3700. We classify the reservation using the following general ledger entry:

| Account | Debit | Credit | Class Tracking |

|---|---|---|---|

| 42100 – Rental Revenue: Airbnb Income – Accommodation Fare | $3000 | Listing A | |

| 42200 – Rental Revenue: Airbnb Income – Cleaning Fee | $500 | Listing A | |

| 51100 – Rental Costs: Airbnb Service Fee | $100 | Listing A | |

| 24200 – Rental Liability: Airbnb Custom Taxes Payable | $300 | Listing A | |

| 11000 – Airbnb Payment Clearing Account | $3700 |

Reservation 2 from Listing B: The total amount to be received from this reservation is $1250. We classify the reservation using the following general ledger entry:

| Account | Debit | Credit | Class Tracking |

|---|---|---|---|

| 42100 – Rental Revenue: Airbnb Income – Accommodation Fare | $1000 | Listing B | |

| 42200 – Rental Revenue: Airbnb Income – Cleaning Fee | $200 | Listing B | |

| 51100 – Rental Costs: Airbnb Service Fee | $50 | Listing B | |

| 24200 – Rental Liability: Airbnb Custom Taxes Payable | $100 | Listing B | |

| 11000 – Airbnb Payment Clearing Account | $1250 |

Refund for Previous Reservation from Listing B: The total amount refunded from a previous reservation is $620. Airbnb automatically subtracts refunds from upcoming payouts, which means we need to classify this event as a part of our reconciliation. For this use the following general ledger entry:

| Account | Debit | Credit | Class Tracking |

|---|---|---|---|

| 42400 – Rental Revenue: Airbnb Refund – Accommodation Fare | $500 | Listing B | |

| 42500 – Rental Revenue: Airbnb Refund – Cleaning Fee | $100 | Listing B | |

| 51100 – Rental Costs: Airbnb Service Fee | $30 | Listing B | |

| 24200 – Rental Liability: Airbnb Custom Taxes Payable | $50 | Listing B | |

| 11000 – Airbnb Payment Clearing Account | $620 |

Reconcile the Airbnb Bank Deposit

Finally, once the Airbnb payout is received and the bank deposit is posted to your bank account (usually 2-5 days after Airbnb sends the payout), it is now time to reconcile the bank transaction for the payout. In order to do this, transfer the money from the Airbnb Payment Clearing Account, back to the bank account with the following entry:

| Account | Debit | Credit |

|---|---|---|

| 1XXXX – Bank Account | $4330 | |

| 11000 – Airbnb Payment Clearing Account | $4330 |

NOTE: To learn more about the Airbnb Payment Clearing Account and the accounting principles behind it, be sure to check out this article: Learn more about the Airbnb Payment Clearing Account

Airbnb Bookkeeping: Automation with Tallybreeze

“Bookkeepers record the day-to-day financial transactions of a business. Accountants, by contrast, focus more on the big picture.” – Investopedia

As you can imagine, manually entering each reservation entry requires painstaking attention to detail, long hours and is prone to errors. The process of Airbnb bookkeeping is best done with automation. In this section, we focus on Tallybreeze (formerly Bnbtally), which integrates Airbnb with QuickBooks or Xero to automate our entries reviewed above.

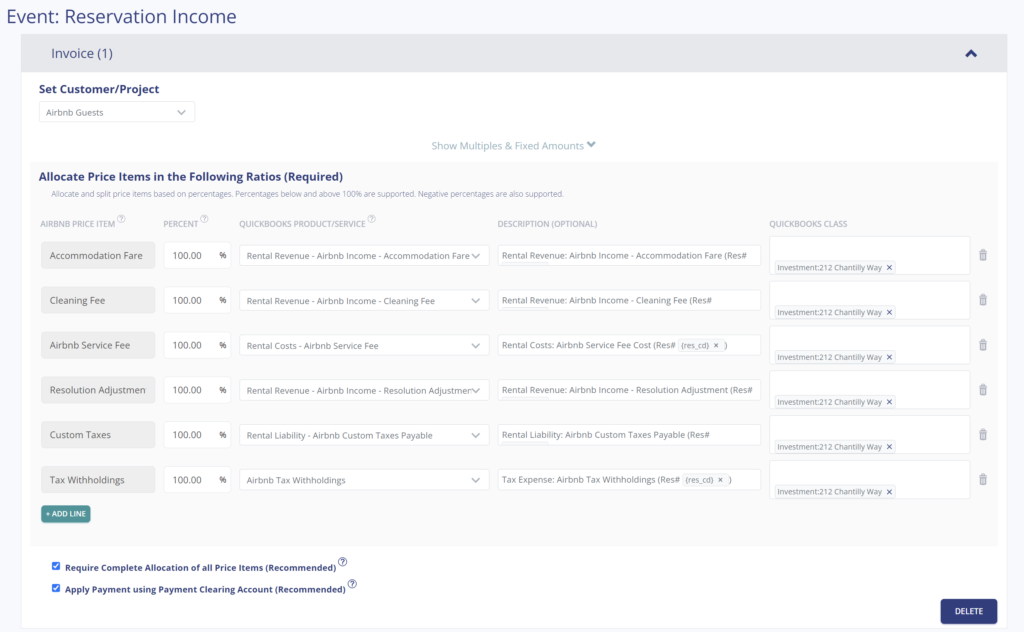

When you set up Tallybreeze, you can connect your Airbnb, QuickBooks and Xero accounts. Tallybreeze will guide you through setting up the accounting rules for each listing and will provide preset options with easy access to the pre-made templates for each business model. After selecting your particular template, your presets will be loaded like so:

With these presets enabled in Tallybreeze, the classification process of Airbnb bookkeeping is completely automated in QuickBooks and Xero. All reservations will be parsed and classified as well as all refunds. For each reservation, Tallybreeze will create an invoice. For each refund, Tallybreeze will create a refund receipt or credit note as needed.

All that’s left is creating a bank rule in QuickBooks or Xero to reconcile the Airbnb Payouts from the bank statement with the Airbnb Payment Clearing Account. Instructions on creating this bank rule can be found here: Airbnb Payment Clearing Account Instructions

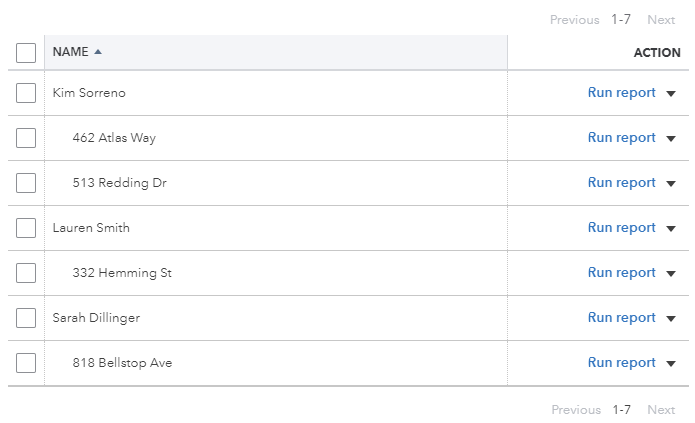

Differentiating between listings

To differentiate between listings, you can make use of QuickBooks class tracking (in Xero it’s called Tracking Categories). It’s best to create a class tracking category for each listing:

Automate Additional Bills & Invoices (Optional)

With Tallybreeze, you’re also able to automate the creation of additional bills and invoices for each reservation. Consider the following:

- Create a bill to set payouts payable to the property owner for each reservation.

- Create a bill to set amounts payable to a tax authority for each reservation.

- Create a bill to set amounts payable to a cleaning service for turnover of each reservation.

- Create additional invoice to set amounts receivable by any third party for each reservation.

Quick Setup Steps

All of the above settings can be quickly set up using Tallybreeze’s presets for QuickBooks or Xero. Here’s how to set up these presets…

- If you haven’t already, Sign Up to Tallybreeze.

- After logging into Tallybreeze, set up your connections, then go to Listing Rules.

- Select any listing you’d like to automate that hasn’t already been set up.

- Select “Load Presets”.

- Select your business model from the options.

From here, presets will be loaded as your listing accounting rules and you can edit as needed.

Airbnb Accounting: Financial Statements & Reporting

“If you can read a nutrition label or a baseball box score, you can learn to read basic financial statements… We all remember Cuba Gooding Jr.’s immortal line from the movie Jerry Maguire, “Show me the money!” Well, that’s what financial statements do. They show you the money. They show you where a company’s money came from, where it went, and where it is now.” – U.S. Securities and Exchange Commission

Now that our data is captured and precisely categorized in our accounting system, we can report on the big picture. We organize this section with a focus on the audience of each report.

Reports for Yourself & Partners

You are obligated to yourself and your own peace-of-mind to run a profitable operation and build your net worth. Airbnb guests are awesome, but not if you’re losing money. Proper Airbnb accounting includes reporting to yourself (and any partners) after paying employees, service providers and creditors. These reports keep you focused on activities that produce wealth.

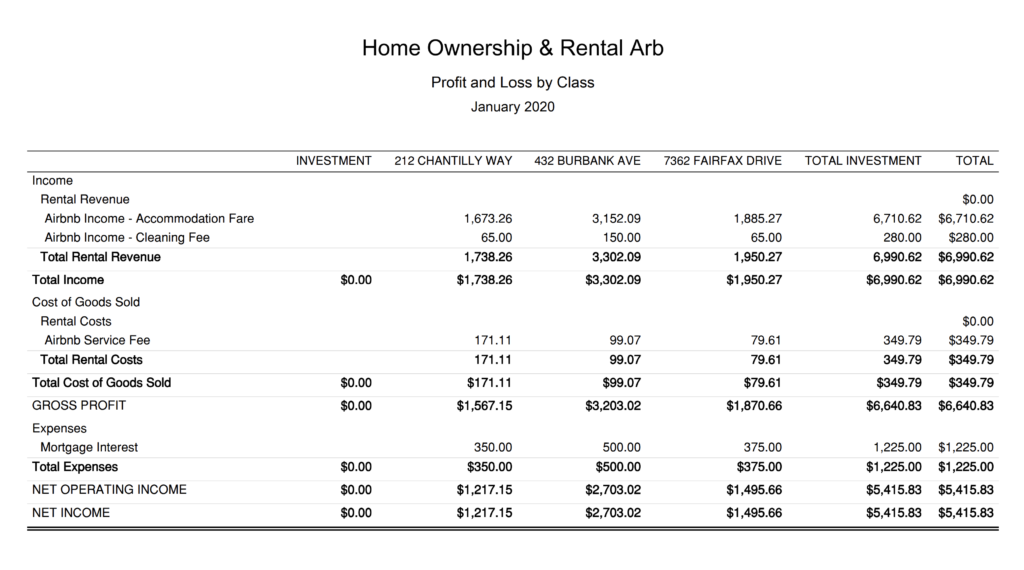

Profit & Loss Statement by Listing

This report is a side-by-side analysis of the profitability and loss of each listing for any duration. This is useful for knowing which locations are performing better or worse, which listing needs your attention, which locations to consider acquiring more properties and which listings to let go (if any):

Read more about the Profit & Loss Statement by Listing: QuickBooks | Xero

Balance Sheet by Listing

If you own your properties, it is especially useful to have a snapshot of any assets and liabilities accumulated for each listing. This includes any mortgage principal owed for any listing as well as any fixed assets for any given date. This would also include any amounts owed to any third parties, such as tax authorities and external stakeholders.

To create this report in QuickBooks Online, select “Reports” on the left menu, then select “Balance Sheet”. From there you can filter the report by listing through the class categories you have set up.

To create this report in Xero, select “Accounting” on the top menu and select “Reports”. From here select “Balance Sheet”. Within the balance sheet you can filter the report by listing through the tracking categories you have set up.

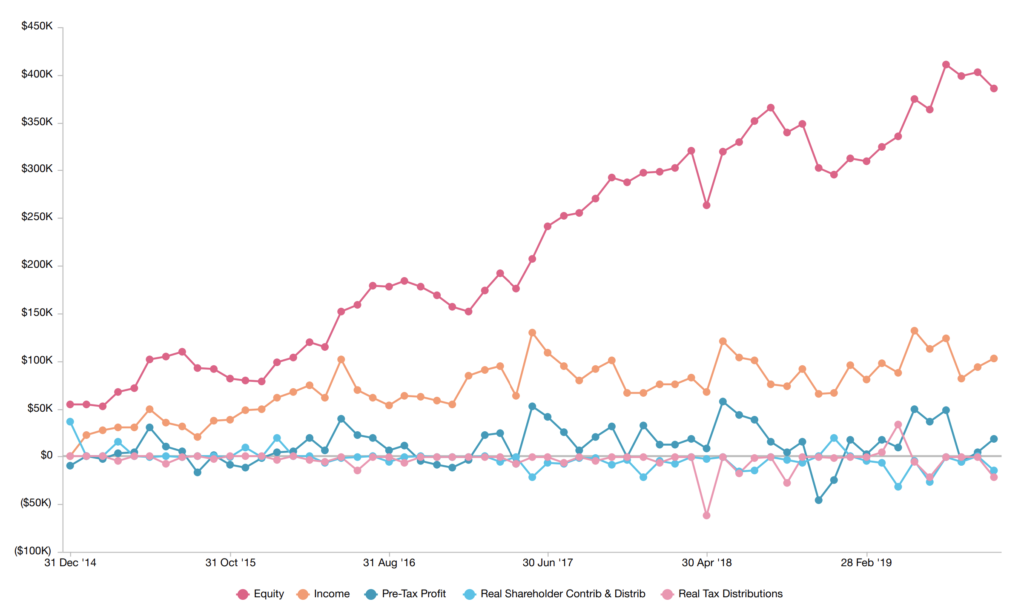

Overall Income, Profit, Contributions, Distributions & Equity

Inspired by Greg Crabtree in his book “Simple Numbers, Straight Talk, Big Profits!” the following chart is a running measurement of your organization’s overall income, profit, contributions, distributions and accumulated equity. This is one of the best charts to monitor the overall health of your organization:

Report to any Investors & Homeowners

If you’re managing properties on behalf of homeowners or real estate investors, you may have a fiduciary obligation to report financial statements and pay rental proceeds. The more transparent you are with your numbers, the more you’ll build trust with your clientele and the more value they’ll see in your services.

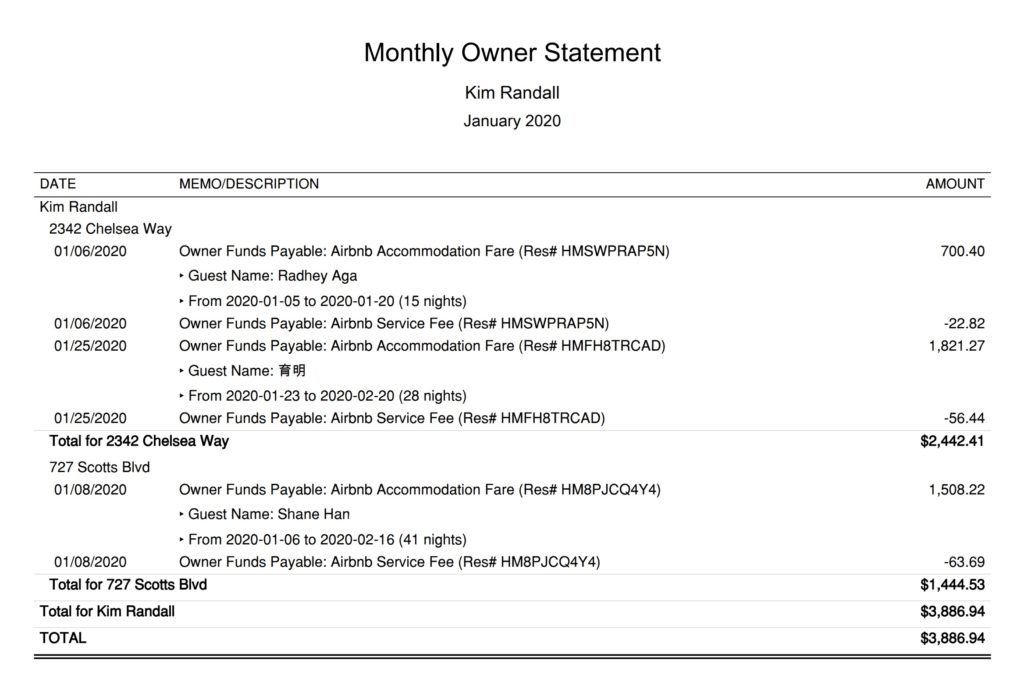

Monthly Owner Statement by Listing

This is a detailed transaction report which provides a snapshot of what the owner has earned for each listing for any given month:

Read more about the Monthly Owner Statement: QuickBooks | Xero

Report to Local Tax Authorities

You’re obligated to report and pay taxes to tax authorities. This includes federal, state and any local transient occupancy taxes. Avoid an audit, pay what’s owed in taxes and don’t pay anything more than you owe.

Airbnb 1099-K

In the United States, each year Airbnb issues form 1099-K to the IRS for each Host who receives $20,000 or more in gross revenues or surpasses 200 transactions by the end of the year. To avoid being questioned by the IRS, you’ll need to report the exact amount shown in box 1a as gross receipts and will need to write off all expenses and refunds from there. If the income recorded on the Airbnb 1099-K differs from what you submit on your tax form, the IRS might flag your return for a review.

It is important to mention that the numbers reported by Airbnb’s 1099-K are what’s considered the gross amount, which means any Airbnb service fees or refunds are not deducted from the 1099-K. However, given that you now have a proper Airbnb accounting system, you can easily find these deductible amounts under the following account codes:

- 51100 – Rental Costs: Airbnb Service Fee

- 42400 – Rental Revenue: Airbnb Refund – Accommodation Fare

- 42500 – Rental Revenue: Airbnb Refund – Cleaning Fee

- 42600 – Rental Revenue: Airbnb Refund – Resolution Adjustment

To learn more about the Airbnb 1099-K read this article: Airbnb 1099-K IRS Tax Filings for Hosts

Opting to Collect Taxes from Airbnb for Transient Occupancy Taxes

In most jurisdictions, Airbnb offers to collect transient occupancy taxes for remittance to local tax authorities on your behalf. However, in many regions Airbnb gives you the choice to receive these taxes yourself and have more control over the funds. This section assumes you’ve decide the latter and therefore need to report to a local tax authority.

In QuickBooks, you can find out how much is owed in custom taxes by selecting “Reports” on the left menu and selecting the “Balance Sheet” report. From there, select the given time frame you wish to report and filter the report using the class tracking category you have set up for your listing. From here, look up the amount you have under the account code “24200 – Rental Liability: Airbnb Custom Taxes Payable”. This is the amount you owe your tax authorities.

In Xero, you can find out how much is owed in custom taxes by selecting “Accounting” on the top menu and selecting “Reports” report. From there, select the report “Balance Sheet”. In the report, select the given date you wish to report and filter the report using the tracking category you have set up for your listing. From here, look up the amount you have under the account code “24200 – Rental Liability: Airbnb Custom Taxes Payable”. This is the amount you owe your tax authorities.

Finally, if your local tax jurisdiction requires you to send a statement proving your numbers, you can send them an Account Transaction report. This report can be filtered by class tracking category for the listing and also filtered on the account “24200 – Rental Liability: Airbnb Custom Taxes Payable”.

Conclusion

Building an Airbnb and short-term rental business can be incredibly rewarding and lucrative, but getting your numbers precise is more important than ever before. Accordingly, a streamlined accounting process is key to making this sort of operation manageable. Plus, the more thorough your Airbnb accounting and bookkeeping methodology, the easier you’ll sleep at night and the more successful you’ll become in this industry.

Above all, these Airbnb accounting methodologies provide a great deal of transparency to all stakeholders involved, including partners, investors, tax authorities and (most importantly) yourself. We hope that you’ve received great value from this guide as you build your firm. To begin automating your Airbnb accounting, check the link below:

Also, if you haven’t already, be sure to check out our guides on each specific Airbnb business model, including chart of account templates and instructions for QuickBooks and Xero:

- Airbnb Investment Accounting: QuickBooks | Xero

- Airbnb Arbitrage Accounting: QuickBooks | Xero

- Airbnb Co-Host Accounting: QuickBooks | Xero

- Airbnb Property Management Accounting: QuickBooks | Xero

- Trust Accounting for Airbnb Property Managers: QuickBooks | Xero

- Airbnb Costs for all Business Models: QuickBooks | Xero

14 thoughts on “Airbnb Accounting & Bookkeeping: A Comprehensive Guide”

Comments are closed.